The Medicare Channel

(800) 728-9609

|

|

|

The Modernized

Medicare Supplement Plan Comparison Chart

This Chart allows you to:

Compare all the Standard Medicare Supplement plans in one easy to read chart.

This standardized Medicare Supplement chart is valid after June 1,

2010 & updated periodically.

Just click on the plan letter to see the specific details about

each plan.

Call us at 1-800-728-9609 to

get a quote from a solid "A" rated company you will know and trust

or submit a Medicare Supplement quote request and we

will call you.

The decision is really not complicated. Most people will select

Plan F

or Plan G.

Plan F

is the best plan and

Plan G

is the 2nd best. To decide if

Plan F

or

Plan G

is the best for you we can do a simple math calculation. Call us to

discuss these 2 options or

generate

your own quote & even apply

quote. We have already done the shopping for you and have

the lowest prices. Give us a call to get your

free quote and email

package today or submit the

quote request form for a free consultation.

|

|

Call to speak to an agent

1-800-728-9609.

Click

here to start your free quote.

As an independent agent we have the

lowest rates.

We still

like to provide good old fashioned customer service. |

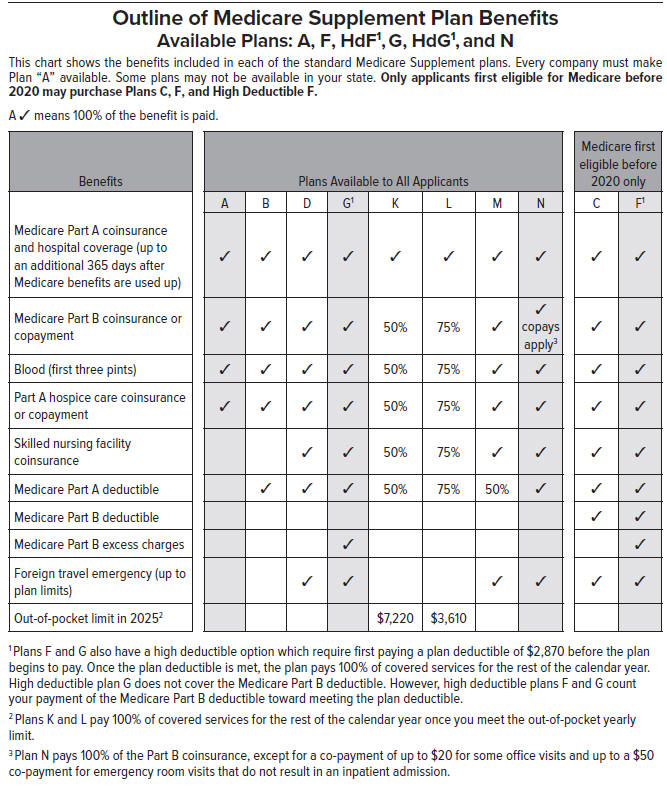

There are 10 Modernized Standardized Medicare Supplement plans “A”

through “N”.

The benefits of each plan are different, with the exception

that all plans are required to cover the “Basic Benefits” which are identified

below. Medicare standardized the plans in 1990 to limit the consumer’s

confusion when comparing coverage offered by different

insurance

companies. However beginning June 1, 2010 the plan chart and

the benefits are changing and improved to meet the changing

health care environment. Some benefits have been eliminated

and several benefits have been added to enhance the Medicare

supplement coverage. With standardization, the consumer can easily

compare the benefits and the cost between the different

insurance companies offering the plans. The words "Medicare

supplement" and MediGap plans are interchangeable and mean

exactly the same thing. The descriptions

of benefits of each of these plans are in the table below.

How to read the

chart: If a check mark appears in the column, this

means the MediGap policy covers the benefit up to

100% of the Medicare-approved amount. If a dash is in

the column the benefit is not covered by the plan. If a column

lists a percentage, this means the MediGap policy covers the benefit at

a percentage rate of the Medicare-approved amount. If no

percentage appears or if the column has a dash,

this means the MediGap policy doesn't cover

the benefit. Note: The coverage of

coinsurance only begins after you have paid the deductible

on plans K & L.

|

Basic Benefits

•Hospitalization Coinsurance for days 61-90 is ($419 per

day) and days 91 and after while using lifetime reserve days

is ($838 per day)

• Payment in full for 365 additional hospital days

• 20% coinsurance for physician and other Medicare Part B

services

Medicare Part A Hospital Deductible

• The 2025 deductible is $1676

Skilled Nursing Facility (SNF) Coinsurance

• $209.50 a day for days 21-100 in a Skilled Nursing

Facility in 2025

Medicare Part B Yearly Deductible

• The 2025 deductible is $257

Medicare Part B Excess Charges

• Difference between doctor's charge and Medicare's approved

amount

• Up to 15% above the Medicare approved charge which is the

doctor’s maximum charge

Foreign Travel Emergency

• Pays 80% of the cost of emergency care during the first

two months of each trip after you pay a $250 deductible

• Lifetime maximum of $50,000

|

|

Call to speak to an agent

1-800-728-9609

|

|

|

Publications:

Medicare at a Glance

Medicare & You

Choosing A MediGap Policy

Medicare's Guide to

Preventive Services

Your Guide to What Medicare Part A & B Covers

|

|

|

Home |Medicare

Supplement Plan Comparison Chart|

Medicare Supplement Quote & Apply |

Contact Me

Privacy Policy

| Terms of Service

©Copyright

2025 The Medicare Channel All Rights

Reserved. This website is a general description of benefits for Medicare

Supplement plans. Although every effort is made as to the accuracy of

the information on this website there is always the possibility of an

error. If you see an error please contact us so we can correct it. The

insurance policy will always determine benefits. Please contact us for

an outline of coverage provided by each of the insurance companies we

represent. Not all plans are available in all areas. If you submit a quote or information request a licensed agent

will contact you. We engage in insurance sales only in the states in

which we are properly licensed. We are currently licensed in

AL, AR, AZ, CO, FL, GA, IA, IL, IN, KS, KY, LA, MD,

MI, MO, MS, NE,

NM, NC, OH, OK, SC, SD, PA, TN, TX,

VA, WA & WV. Not

affiliated with, authorized by or endorsed by the U.S. government or the

federal Medicare program.

"I do not offer every plan

available in your area.

Currently I represent Four (4) organizations which offer Twelve 12

Prescription Drug Plans (PDP's) in your area.

I currently don't recommend or offer MAPD (Medicare Advantage

Prescription Drug Plans) or MA (Medicare Advantage) plans in any area.

Please contact Medicare.gov, 1-800-MEDICARE, or your local State Health

Insurance Program (SHIP) to get information on all of your options.”

I am an independent broker and work with many insurance

companies.

I do have the lowest medicare supplement prices.

For more information feel free to

Contact Me.

|

|

|